This article has been written to explain to a business owner how he can decide the perfect price for his products.

Table of Contents

Introduction

If your business is just starting, you cannot go wrong with the price point.

If it is too high you scare the customers away and if it is too low you don’t make a profit.

Pricing perfectly is tough— which is why new business owners frequently get stuck with questions like, ‘Am I charging too much?’, ‘Am I going to lose money with this price?’ and more.

The good news? Creating a strategy to attract customers, beat competitors, and grow your profits is easier than you think. All you need to learn is the perfect pricing strategy.

In this article, I will share with you how to price your product or service correctly on every occasion. Let’s dive in!

Why is setting the right price so important?

Before setting your price, it’s crucial to understand why it even matters. If done right, it can turn out to be a game changer for your business.

Here are a few reasons why it’s so important:

- In a way, price also indicates the worth of the product, as it gives customers the idea that high prices equal high quality while low prices equal cheap. Also, if you set the prices too high, customers may become hesitant to purchase the product. The tip is to find a balanced price.

- Pricing decides your profits. Low prices cut profit and high prices boost profit margin but they also reduce sales. As a business owner, you need to run split tests of different prices to see what works best when you’re looking to optimize profit.

- A fair price keeps customers coming back. Focus on the value your product provides while setting the right price.

- Your pricing sets how the customer thinks about you versus your competition. If you offer a good price range with good value you keep lots of competition away and don’t damage your brand.

Steps to set the price of your product or service

Pricing might seem complex, but trust me it’s not. Once you go through this and apply it to your business, finding the right price will take less than 30 minutes.

Ready to spend 30 minutes for higher profits and more sales?

Step 1: Understand the type of your business

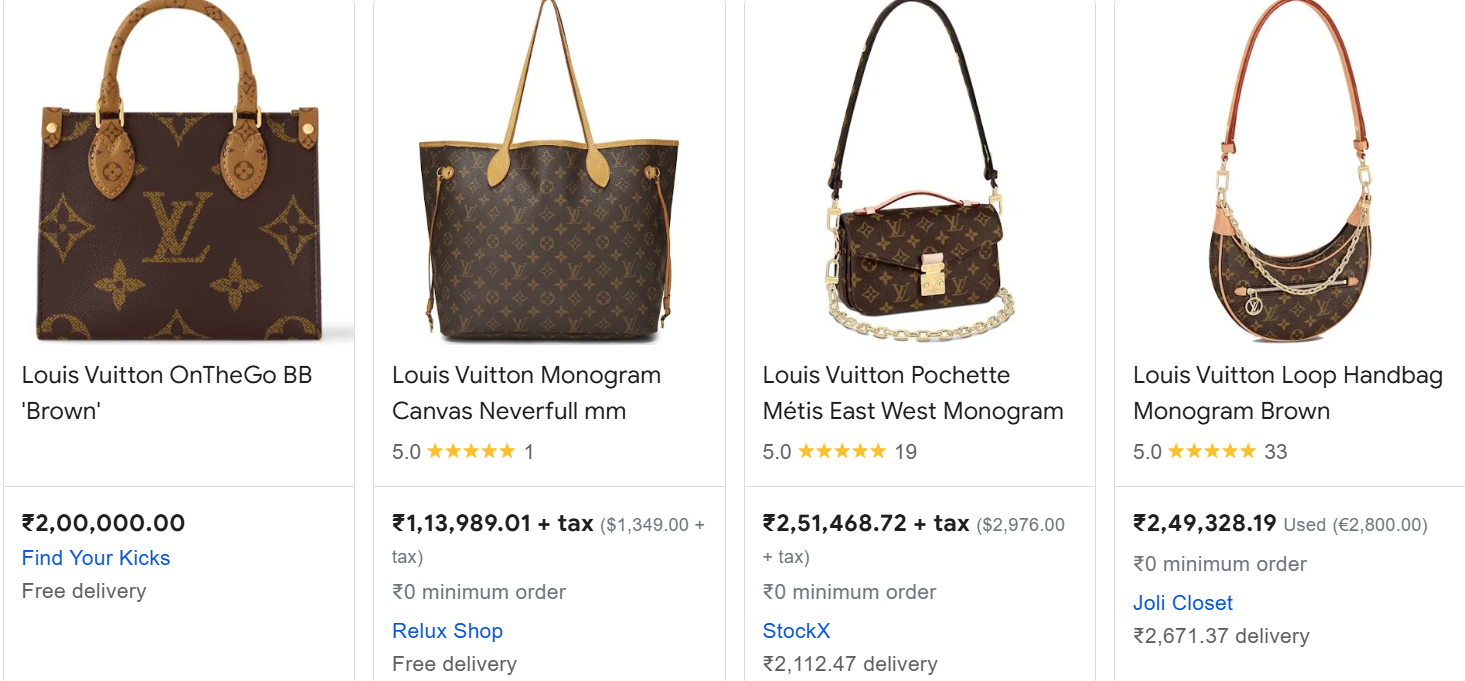

Ever thought why a handbag of a luxury brand costs lakhs but the same quality of bag can be found in your local market for a few hundred bucks?

Is it about quality?

No, It is about the brand value.

You might think if you even double the price of your product/service, the sales might keep crashing down.

But then how are some companies able to not just survive, but thrive with such high pricing?

The key here is to know your business and price accordingly. What makes these businesses different is that they do not target everyone, instead, they only target the upper class.

However the quality doesn’t justify their super high prices but they do justify something else, which is status and exclusivity.

For example, look at Rolex – It is not just a watch but a status symbol!

You too need to understand your business and think about where you want to position your product or service. It is going to be:

- as a massy product that everybody buys;

- a premium product that only the upper class buys, or;

- somewhere in between.

To understand this pricing strategy, you need to first identify the kind of business you have. It will help you understand which category you belong to:

- Mass-market businesses

The focus of these businesses is to keep prices as low as possible and get high sales volume. That makes them target everyone. They sell everyday essentials like groceries, household items, clothing, etc.

- Premium or luxury businesses

These are businesses that sell high-quality or exclusive products for people who can afford to pay more. The product however isn’t essential in these cases. Instead, it’s about status and lifestyle. Examples include luxury cars, designer clothes, high-end watches, etc.

- Niche market businesses

These businesses cater to a specific group of customers who have unique needs or interests. Instead of targeting everyone, they focus on solving a specific niche problem or meeting a particular demand. Examples include eco-friendly products, handmade crafts, vegan food, etc.

Think about which category you belong to because the right pricing strategy will be different for different kinds of businesses. Analyze your business by asking yourself the following questions:

- Are you after a large crowd, a small group with specific needs, or customers who are seeking ultimate or premium experiences?

- Are you offering a basic necessity, a unique solution, or a luxury item?

- Are you looking to generate high sales volume, high profit margin, or customer loyalty?

These questions will help figure out which type of business you have. After that is done, you can continue to the next steps.

Step 2: Calculate the minimum price you can sell at

The next step is to figure out how much it costs you to deliver the product or service. Knowing the costs is very important regardless of which type of business you are commencing. If your price doesn’t at least cover such costs, you’ll lose money on each sale.

Now you may already know the manufacturing cost of each product but that’s not all. You have to calculate each expense which is incurred, such as marketing expenses or delivery costs. Here are the costs you need to take into account:

- Direct costs: They are raw materials, salaries, and production supplies which are incurred directly for the product or services you offer.

- Indirect costs: These costs do not directly affect the product or service but they still need to be taken into account like rent, maintenance, insurance, etc.

- Selling costs: These are all costs that are necessary to provide the product/service to the customers like advertising costs, sales commission, shipping, etc.

- Other costs: They include all costs that do not fall into any category, such as bad debts or taxes.

Finally, you need to know the cost per unit of your product meaning how much it costs in total for you to produce and sell each product or service. The cost per unit is the minimum price that you can charge per product/service. Here’s how to calculate the cost per unit:

- Now that you have all the expenses listed down, add them all up for a specific period, maybe 1 month or 1 year. Call this your total expenses.

- Next, look at how many units of product you produced during that same period or how many units of services you provided.

- Divide total expenses by the number of units.

The amount you see after the last step is the cost per unit of your product and it is the minimum amount that you must charge else you will end up selling at a loss. Here’s an example of calculating cost per unit:

Total expenses: Rs 85,000

Units produced: Rs 1,000

Cost per unit: 85,000 ÷ 1,000 = Rs 85/-

Your minimum price should be at least equal to the cost per unit (Rs 85 as per example) to be at the break-even point, and not sell at a loss.

Step 3: Add a profit margin to the minimum price

You would not want to just run the business at break even, right? You’d also want to add a profit margin. You might be confused about how much you should add, but that depends on many different factors.

Remember when I told you to figure out which category of business you belonged to, in the first step? Now is the time to put them to use. Here’s how much profit margin to add depending on which category your business belongs to:

- For mass-market businesses

Mass-market businesses should add anything between 5%-20% as their profit margins because customers in this segment here are price sensitive and there are many competitors.

A 5%-20% profit margin will still work for these businesses because the sales volume is usually high so the net profit is also higher.

If you keep the profit margin in mass-market businesses below 5%, it could cause problems like you may not be able to handle any sudden unexpected expense, or it could also trigger a price war between you and your competitors, which will benefit nobody in the end.

However, if you keep a profit margin above 20%, it could push customers away as you might not be able to justify the higher costs because almost all products in this category of businesses are generic. Not only that, but it will lead to lesser sales and eventually lesser net profits even after having a higher margin.

Example: A burger shop works with very slim profit margins as they are in a highly competitive food industry with price–sensitive customers.

- Pricing: A Double Cheese Burger costs around $2.00.

- Cost of Goods Sold (COGS): Ingredients, labor, and overhead costs combined are approximately $1.60 a burger.

- Gross Profit: With this, gross profit per burger goes down to $0.40.

- Gross Profit Margin: It is calculated as 20% ($0.40 ÷ $2.00).

- For premium or luxury businesses

The profit margin for premium or luxury businesses should be anything beyond 140% because the customers expect luxury and exclusivity and often perceive premium-priced products as better quality.

A profit margin above 140% works for these kinds of businesses because it positions them as high-end and sets the product apart from mass offerings. Because of the higher profit margin, even after a smaller amount of sales, the businesses make good overall net profit.

If you keep the profit margin below 140%, it will make your product fall in the “no man’s land” meaning it will attract nobody. Price-sensitive customers will go to mass-market businesses while customers with higher purchasing powers will not perceive it as luxury or exclusive.

Example: Rolex and other luxury watch brands aim to have huge margins to position themselves in the high-end market.

- Pricing: A typical Rolex Submariner will retail between $8,000.

- Cost of Goods Sold (COGS): Labor and materials add up to approximately $2,000 per watch.

- Gross Profit: Therefore, for every watch, a gross profit is earned at $6,000.

- Gross Profit Margin: It’s calculated as 300% ($6,000 ÷ $2,000).

- Niche market businesses

The profit margin for premium or niche market businesses should be anywhere between 20-40% because the customers are looking for something specific and a product or service that solves their specific needs or problems.

These businesses keep a 20-40% profit margin because niche products are unique and not easy to get. That is why customers are willing to pay slightly more to solve their specific requirements.

If you keep the profit margin below 20% then it may make your customers perceive the product/service as less valuable or not so specialized. Lower profits could also affect your ability to introduce more innovations which is very important in niche businesses.

However, a profit margin above 40% could make even loyal customers feel the price is not justified. Most importantly, higher prices may easily motivate your competitors to bring similar products at a lower price.

Example: This concept is used very nicely by a company that specializes in software solutions for non-profit organizations.

- Product: Non-profit fundraising and donor management software.

- Pricing: Plans range from $5,000 to $25,000 annually depending on features, and organization size.

- Cost of Goods Sold (COGS): The approximate costs are $3,000 per subscription for development, maintenance, and support.

- Gross Profit: This amounts to a gross profit between $2,000 and $22,000 per subscription.

- Gross Profit Margin: This is calculated as 40% to 88% (e.g., $2,000 ÷ $5,000 = 40%).

Now those were the steps using which you can come to an approximate number which you can charge for your product and service. But that’s not the “exact” price, is it?

Step 4: Different pricing models that big brands use

The exact price cannot be just any random number between the approximates but it needs to be carefully sought upon.

And that is why a lot of businesses charge Rs 999/- instead of Rs 1000/-. Why do you think they do that? Do you think it’s the only pricing model that they have?

Absolutely not. There are many such pricing models which you can adapt to have your “exact” price. Here are some pricing models and how they help you:

- Charm pricing

It means pricing your products or services near a round number, for example, ₹999 instead of ₹1000.

Customers perceive the pricing as being much lower than the actual price when you use this pricing model. Though the gap is still small, customers perceive ₹999 as near ₹900 rather than ₹1000.

Example: Apple usually prices its products at $549 rather than $550.

- Bundle pricing

This means offering many products together at one reduced price which would be impossible to offer if these products were purchased individually.

The customers feel that because they’re paying less per piece, they are getting more value and will purchase more items.

Example: Combo meals provided by McDonald’s include a burger, fries, as well as a soft drink at a lower price than what the customer would have to pay if they purchased each item separately.

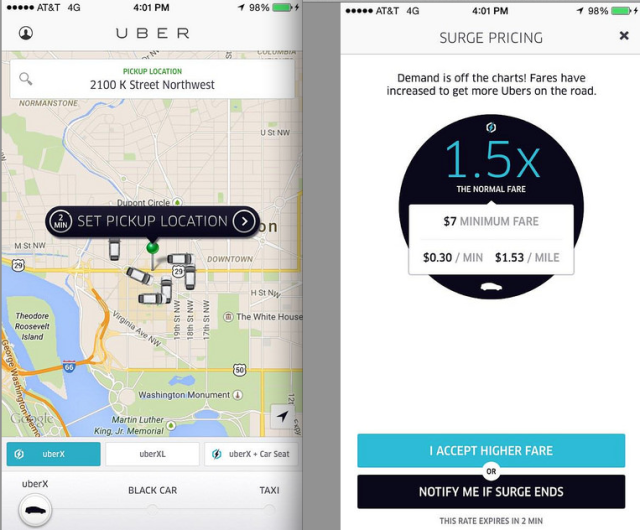

- Dynamic pricing

It is the real-time adjustment of prices according to the demand, availability, or market conditions. This pricing model enables businesses to make high profits when there’s high demand and to acquire customers when there is low demand.

Example: Fares are adjusted by Uber based on demand as at peak times fares are higher, and it is lower during off-peak hours.

- Value-based pricing

It is pricing from the perception of the customer’s value of the product and not from the costs incurred while manufacturing or selling the product. This pricing model allows you to charge what customers are willing to pay while also pointing out what is different and of the greatest value in the product.

Example: Luxury car manufacturers set their prices according to performance, design, and brand reputation.

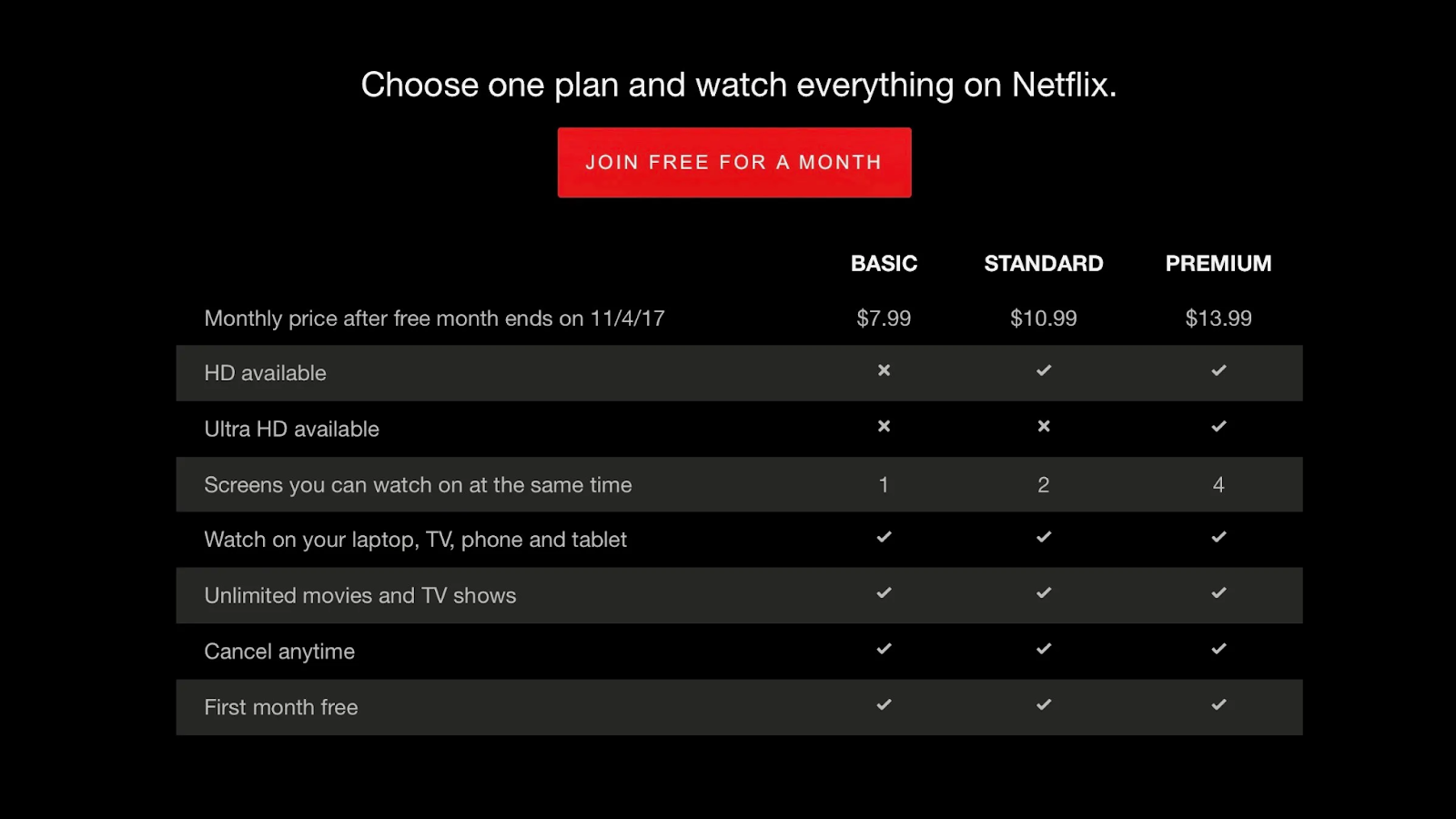

- Subscription pricing

This is when customers are charged on a repeat basis (i.e. charged monthly or annually) as long as they continue to use the product or the service.

This pricing model not only builds a solid, steady, and predictable revenue stream, but it also builds long-term customer relationships.

Example: Access to Netflix content library costs a monthly fee.

- Decoy pricing

This refers to giving three pricing options created to make the center or middle option appear much more appealing.

This pricing model creates a situation where customers tend to pick the middle option because it’s perceived as offering the most value for money when in reality it’s most profitable for the business.

Example: Medium-sized popcorn at a movie theater costs $6.50 while a large popcorn costs $7, and a small popcorn costs $3. Strategically priced medium options are often chosen by the customer as compared to large popcorn.

However, you may be confused as to which of these pricing models will be suitable for your business and which models may not be.

That is a valid concern because every business is different and every product or service is different. However we will not let this concern be a problem for you, so ask yourself the following questions:

- Who is my target audience?

- Mass-market customers? Select a model like charm or bundle pricing.

- Premium customers? Think about value-based or decoy pricing

- Niche customers? Choose value-based or subscription pricing.

- What are my business goals?

- High sales volume? This is where charm and bundle pricing come in.

- Building brand prestige? Value-based pricing is key.

- Customer loyalty? This is where subscription pricing works best.

- How do customers perceive my product?

- When it comes to customers who value savings, charm and bundle pricing can work.

- If they prefer being exclusive, choose value pricing and decoy pricing.

Step 5: How to improve the price consistently?

You might have already set a price for your product but is it final? Maybe yes, but for how long? The market keeps changing every quarter or year. New competitors enter the market as well as the cost of production changes often.

And they are the exact reasons why you cannot just set your pricing once and leave it there. It is a process of constant improvement. You need to constantly test and refine your pricing strategy to be on the top of your game.

Here are two simple methods to constantly improve your pricing:

- A/B testing

This refers to testing two different kinds of pricing on two different sets of similar customers to see which one performs the best. As the name suggests, you have to divide your customers into two groups, which are Group A and Group B.

Now come up with two different kinds of pricing that you want to test in your business and use one of them on group A customers and another one on group B customers.

At the end of a specific period, check which group of customers brought the most profit to you. Check which pricing technique you used on that group of customers because that is what’s going to work the best for your business.

This is also called split-testing and it is very popular in all types of businesses as this testing makes it very easy to understand which pricing model works the best.

- Direct customer feedback

There’s no better way to test and refine anything in business than directly talking to customers.

After your customers purchase something from you, send them an email or give them a survey form asking for their opinions on perceived fairness, satisfaction, and overall value of the product/service.

If it’s positive, great. If not, you have some work to do. Not only that, but you can also observe the repeat as well as return rate of your products. If customers purchase your product repeatedly, it means they find it valuable so you can increase prices slowly.

However, if they don’t purchase repeatedly then it means they did not find enough value in your product. Solution? Either lower the price or improve the product/service.

Common mistakes to avoid while setting price for your product/service

- Underpricing to attract customers

Business owners, for example, may choose to price their products or services very low to compete or to quickly attract more customers, but the drawbacks are that underpricing causes a customer to feel as though the product is cheap or of poor quality. Not only that but the more you scale, the harder it becomes to get good profit margins. Instead of focusing on price, make sure to focus on value.

- Not understanding your target audience

Many businesses assume their product is for everyone. This often leads to pricing that doesn’t match what their customers are willing to pay. Understand your target audience and their needs, then set a price that aligns with what they value and are ready to spend.

- Overcomplicating pricing

Complicated pricing structures with too many options can confuse customers. If they can’t understand your pricing, they may choose a simpler option from a competitor, so keep your pricing clear and easy to understand.

- Overlooking testing and adjusting prices

Many businesses set a price and never change it, even when the market changes. This can lead to lost opportunities or profits. Test different prices to see what works best. Use customer feedback and sales data to adjust your pricing over time.

- Copying competitor prices blindly

Many businesses copy their competitor’s prices without understanding their own costs or customer base. This can lead to setting prices that don’t suit your business. Instead, focus on your unique value and set prices based on your costs and goals.

- Offering too many discounts

Giving frequent discounts might attract customers initially, but it also gives them the idea that it is more cost-effective to buy at a discount than paying full price. This can hurt your profit and devalue your product. Offer discounts occasionally and make them feel special or limited.

- Ignoring market trends

Market trends, like inflation or new competitors, can change what customers are willing to pay. Sticking to old prices might lead to losses. Keep an eye on the market and adjust your pricing as needed to stay competitive.

- Being inconsistent with pricing

Changing prices too often or without explanation can confuse and upset customers. They might feel they’re being treated unfairly. Keep your pricing consistent and explain changes clearly when necessary.

Conclusion

There’s no reason pricing your products or services should feel stressful or risky. Understanding your business type, calculating your costs, establishing your ideal profit margin, and choosing a pricing model that will work for your business, is how you set the perfect price to boost your profits.

Pricing is not just numbers, remember. Not only does it help you position your business for growth but it also makes your customers satisfied and happier. All these steps will help you strike the perfect balance with high sales volumes, brand premiums, and customer loyalty.

Consider taking time to apply these steps. Once you get your pricing right, you’ll realize that it affects not only your revenue but also your brand impression and customer satisfaction.

Go ahead and apply what you’ve learned and let your pricing strategy take you to where you want or where you want to reach! You’ve got this!

Frequently Asked Questions (FAQs)

- How often should I review my pricing strategy?

It’s a good idea to review your pricing strategy at least once a year or whenever there are major changes in your costs, market trends, or competition. Regularly evaluating your prices helps ensure they remain competitive and profitable.

- How can I justify a higher price to my customers?

Highlight what makes your product unique or better than competitors. Focus on quality, features, benefits, or exclusivity. Use customer testimonials, warranties, or guarantees to build trust and show the value of your product.

- Is it okay to adjust prices after launching?

Yes, adjusting prices is common. If you find that your initial price isn’t working, you can test new prices. Just communicate the changes clearly to customers to maintain trust.

- Should I have the same price for online and in-store sales?

Not always. Online pricing often includes shipping costs or discounts to compete with other e-commerce platforms. In-store pricing might reflect overhead costs like rent. Analyze your expenses and customer behavior to decide if you need different pricing.

- How do I handle competitors who keep lowering their prices?

Instead of joining a price war, focus on what makes your product unique. Emphasize quality, customer service, or added value that competitors can’t easily replicate. Customers will often pay more for a product they trust, or which they feel is worth the price.

- How can I attract price-sensitive customers without lowering my prices?

Offer discounts on bundles, loyalty rewards, or limited-time deals instead of permanently lowering prices. You can also provide added value, like free shipping, extended warranties, or exceptional customer service, to make your price more appealing.

- What role does branding play in pricing?

Strong branding can allow you to charge higher prices because customers trust your products and see them as valuable. A well-known brand like Apple can price products higher because of its reputation for quality and innovation.

- How do I price a service that is time-based?

Calculate the cost of your time, including preparation, delivery, and expertise, and add a profit margin. Consider the value your service provides to clients and compare your rates with competitors to find a competitive but fair price.

- Should I set prices based on industry averages?

Industry averages can provide a benchmark, but your pricing should reflect your unique costs, value, and market position. If your product offers more value, don’t hesitate to price above the average.

- Should I use pay-what-you-want pricing?

Pay-what-you-want pricing can work for creative or charitable products where the customer determines the value. It builds goodwill but might not be sustainable for businesses that rely on consistent revenue.

- What is the difference between cost-plus pricing and value-based pricing?

Cost-plus pricing adds a fixed margin to the product’s production cost, ensuring profit. Value-based pricing sets the price based on the perceived value to the customer, regardless of production cost.

- How do I determine the perceived value of my product?

Determine perceived value by gathering customer feedback, analyzing competitors, and understanding how your product solves pain points or offers unique benefits. Focus on the emotional appeal, quality, and outcomes that your product delivers.

- What are the risks of underpricing or overpricing?

Underpricing risks include low-profit margins, brand devaluation, and attracting price-sensitive customers who may not stay loyal. Overpricing can reduce sales, alienate potential customers, and give competitors an edge, damaging long-term growth.

- Can dynamic pricing hurt customer trust?

Yes, frequent price changes can frustrate customers, creating a sense of unfairness or exploitation. Transparent communication and value justification can mitigate this risk.

- Are there specific tools to help me choose the right pricing model?

Yes, tools like ProfitWell, Price Intelligently, and Competera analyze market trends, customer data, and competitor pricing to guide your strategy.

Leave a Reply